Community Calendar

Events for October 2024

Next Level Leader

Fairfield, IAOctober 1, 2024 For More Information

Contact: Mendy McAdams

(641) 472-2111

Mendy@fairfieldiowa.com

Website

4:00 pm

Jefferson County Health Center- Conference Room C

Jefferson County Health Center Parkinson's Support Group

2000 S. Main St.Fairfield, IA

Map to Event

October 1, 2024

4:00 pm

Join JCHC Therapy Services for our Parkinson's Disease Support Group. We focus on learning, sharing experiences, and establishing connections in a welcoming, comforting environment. The Jefferson County Parkinson’s Support Group is a Community Group that meets once a month with support from JCHC and the Iowa Chapter of the American Parkinson’s Disease Association (APDA)- “Strength in Optimism. Hope in Progress." The purpose of the group is to learn by talking with others and sharing experiences, tips, ideas about living with PD or about being a care partner.

For More InformationContact: Michelle Boeding-Kreuter

(641) 469-4353

mboeding-kreuter@jchc.org

Website

4:00 pm

Jefferson County Health Center Conference Room C

Jefferson County Health Center Parkinson's Support Group

2000 S. Main StFairfield, IA

Map to Event

October 1, 2024

4:00 pm

The Jefferson County Parkinson’s Support Group is a Community Group that meets once a month with support from JCHC and the Iowa Chapter of the American Parkinson’s Disease Association (APDA)- “Strength in Optimism. Hope in Progress.” The purpose of the group is to learn by talking with others and sharing experiences, tips, ideas about living with PD or about being a care partner.

Please enter using the McCreery Cancer Center doors.

For More Informationmboeding-kreuter@jchc.org

7:00 pm to 8:45 pm

Sondheim Center for Performing Arts

Widow Clicquot

200 N. Main StreetFairfield, IA

Map to Event

October 1, 2024

7:00 pm · 8:45 pm

Widow Clicquot is based on the true story of the “Grande Dame of Champagne,” Barbe-Nicole Ponsardin (1777–1866) who, at the age of 20, became Madame Clicquot after marrying the scion of a winemaking family. Though their marriage was arranged, a timeless love blossomed between Barbe-Nicole (Haley Bennett) and her unconventional, erratic husband, François (Tom Sturridge). After her husband’s untimely death, Barbe-Nicole flouts convention by assuming the reins of the fledgling wine business they had nurtured together. Steering the company through dizzying political and financial reversals, she defies her critics and revolutionizes the champagne industry to become one of the world’s first great entrepreneurs.

Critics are calling it a dramatic, romantic, elevated “girl boss” story that effervesces. A regional exclusive screening!

“Centering around Haley Bennett’s sparkling performance, Widow Clicquot is a visually impressive tale of resilience that leaves a pleasing aftertaste on the palette.”

~ Rotten Tomatoes

For More Informationinfo@fairfieldacc.com

3:00 pm to 6:00 pm

On the Square

Summer Outdoor Farmer's Market

October 2, 2024

3:00 pm · 6:00 pm

Summer Outdoor Market

Now through October 30

Wednesdays on the Square 3:00-6:00pm

Saturdays at Howard Park 8:00am- 1:00pm

6:00 pm to 7:00 pm

Behner Funeral Home

Coffee, Cookies, and Conversation

203 South Main StreetFairfield, IA

Map to Event

October 2, 2024

6:00 pm · 7:00 pm For More Information

Contact: Rachel Brown

(641) 472-4116

beh4116@hotmail.com

Website

7:00 pm

Via Zoom at https://us06web.zoom.us/webinar/register/9217267820553/WN_it2-3tmcR56i9aCNp1TG5g

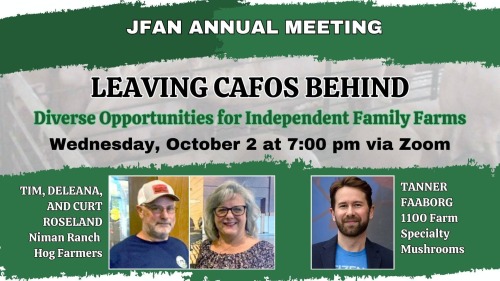

Leaving CAFOs Behind: Diverse Opportunities for Independent Farms

October 2, 2024

7:00 pm

Is it possible to transform a factory farm into a sustainable farming operation? YES! Find out how these two farming families did that in two very different ways! What does it take for a CAFO operator to transform a factory farm into an independent, sustainable farming operation? Two different farming families will share just how they did that at the upcoming JFAN Annual Meeting. Tim, Deleana and Curt Roseland transitioned their CAFO into a humane, sustainable hoop house operation to raise hogs for Niman Ranch. Tanner Faaborg, recently profiled in a New York Times article, converted his family’s 2200-head contract operation with Iowa Select into a specialty mushroom farm for medicinal tinctures and a coffee blend. Each will share how their similar beginnings of raising hogs took different turns when shuttering their CAFOs. Tim and Deleana Roseland will talk about why they first raised hogs in confinement, what precipitated their decision to switch to hoop houses to independently raise hogs for Niman Ranch, and what it took to do that. Their son, Curt, will share his experiences of joining the family farm and why he encourages other young farmers to raise hogs traditionally rather than becoming trapped with a CAFO. Following the Roselands, Alicia LaPorte, Niman Ranch Executive Director, will share the findings of a 2019 Iowa State University report that reveals how much Niman Ranch’s independent livestock producers contribute to Iowa’s economy. Tanner Faaborg will talk about what it was like for his family to operate their CAFO, including experiences contracting with Iowa Select, and why they decided to stop. He’ll share how, with the blessings of his family, he is developing the former hog confinement into a specialty mushroom farm, aptly named 1100 Farm, and rewilding the property in the process. Tanner will include how he convinced his brother, a lifelong Iowa Select employee, to leave CAFOs behind and join him in the business. He’ll also outline his vision of using the farm as a model so other farmers can see there are viable, enjoyable alternatives to industrial livestock production and that it’s possible to transition away from CAFOs. Rounding out the evening Kara Shannon, Director of Farm Animal Welfare Policy at the ASPCA, will give a brief overview and status report of the Ending Agricultural Trade Suppression (EATS) Act, a part of the 2024 Farm Bill under negotiation, that would harm the Roselands and other independent livestock farmers who now have access to the California market through Proposition 12. An audience Question and Answer session will follow the presentations.

Contact: Diane Rosenberg

Phone: (641) 919-5002

E-mail: jfan@lisco.com

Website: https://www.jfaniowa.org/leaving-cafos-behind

Facebook: https://www.facebook.com/events/1041949524052840/?acontext=%7B%22event_action_history%22%3A[]%7D

Contact: Diane Rosenberg

(641) 919-5002

jfan@lisco.com

Website

6:00 pm to 8:00 pm

Noble House Kava

Pumpkin Decorating

115 N. Main StreetFairfield, IA

Map to Event

October 3, 2024

6:00 pm · 8:00 pm

![]() Pumpkin Decorating at Noble House Kava

Pumpkin Decorating at Noble House Kava ![]()

Join us for a fun evening of pumpkin decorating at Noble House Kava on October 3rd at 6 PM!

Bring your creativity and enjoy an autumn-inspired activity with friends and family. Pumpkins and decorating supplies will be provided. All ages are welcome! ![]()

![]()

![]() Location: 115 N Main Street, Fairfield, IA

Location: 115 N Main Street, Fairfield, IA

![]() Date: October 3rd

Date: October 3rd

![]() Time: 6:00 PM

Time: 6:00 PM

We can't wait to see your spooky, silly, and creative pumpkin designs! ![]()

6:45 pm to 8:30 pm

Fairfield Community Center (upper level)

Border Wall Presentation

209 S. Court StreetFairfield , IA

Map to Event

October 3, 2024

6:45 pm · 8:30 pm

State Senator Adrian Dickey will be giving a talk with visuals on his recent 5 day trip to the Southern Border. Come get the facts and ask questions from your local elected official on how this impacts us here in Iowa. Sponsored by the Jefferson County IA Republican Women's Club. Meeting 6:30, presentation starts at 7pm sharp. Snacks provided by JCIRW.

For More InformationContact: Mary Jones

(319) 540-4551

Connect@jcirw.org

Website

6:45 pm to 8:30 pm

Fairfield Community Center (upper level)

Border Wall Presentation

209 S. Court StreetFairfield , IA

Map to Event

October 3, 2024

6:45 pm · 8:30 pm

State Senator Adrian Dickey will be giving a talk with visuals on his recent 5 day trip to the Southern Border. Come get the facts and ask questions from your local elected official on how this impacts us here in Iowa. Sponsored by the Jefferson County IA Republican Women's Club. Meeting 6:30, presentation starts at 7pm sharp. Snacks provided by JCIRW.

For More InformationContact: Mary Jones

(319) 540-4551

Connect@jcirw.org

Website

OB Nelson

Youth Soccer & Flag Football Camp for K-6th

October 5, 2024

City of Fairfield Parks and Recreation Youth Soccer and Flag Football dates have been set for 2024!

Forms will be distributed to local schools the week of August 26th but take note: in order to guarantee that your participant gets the t-shirt size they need, participants need to be registered by Friday, August 30th. We know that's a tight timeline which is why REGISTRATION IS OPEN RIGHT NOW! Forms are available at the front desk but you don't even need to come in, call us weekdays between open and 4:00pm and we'll get you registered over the phone (641)472-6159

*additional 2.5% fee for credit card transactions, minimum fee of $1.95

8:00 am to 1:00 pm

Howard Park

Summer Outdoor Farmer's Market

October 5, 2024

8:00 am · 1:00 pm

Summer Outdoor Market

Now through October 30

Wednesdays on the Square 3:00-6:00pm

Saturdays at Howard Park 8:00am- 1:00pm

8:00 am to 1:00 pm

Howard Park

Farmers Market

East Grimes Ave and North Main StFairfield, IA

Map to Event

October 5, 2024

8:00 am · 1:00 pm

Nothing beats fresh grown produce and if that’s your thing, then head to the Fairfield Farmers market! Fairfield’s Farmers Market is a popular and festive summer event where fresh local produce catches your eye in every direction you look. All the items sold at the Farmers market are home grown and produced right here in Jefferson County. Alongside the array of fruits, vegetables, and baked goods, local vendors provide a vast selection of handmade arts and crafts Located in Howard Park, which is close by the new Fairfield Arts and Convention Center, the Farmers Market begins the first Saturday of May and continues until the last Saturday of October. The park offers a well-equipped playground for the kids to run around while you handpick your goodies. The Farmers Market is open Wednesdays and Saturdays May through October

9:00 am to 11:30 am

Iowa Young Birders: Jefferson County Park Field Trip

October 5, 2024

9:00 am · 11:30 am

Join us for a morning of birding at Jefferson County Park with Jefferson County Conservation! We hope to catch the tail end of the songbird migration and the front end of the waterfowl migration. There will be plenty of birds to see and fun to be had! This trip is free, but advanced registration is required.

Iowa Young Birders welcomes everyone to the outdoors regardless of age, race, ethnicity, gender, orientation, religion, creed, national origin, or disability status. Our events can accommodate wheelchairs, vision and hearing impairments, and other health conditions. For questions, or to request accommodations for an upcoming event, please send us a message or email. As an IAYB event, this field trip is open to young birders and their parents/guardians/caretakers.

9:00 am to 11:30 am

Cedar View Trail

Iowa Young Birders: Jefferson County Park Field Trip

2164 South 32ndFairfield, IA

Map to Event

October 5, 2024

9:00 am · 11:30 am

Join us for a morning of birding at Jefferson County Park with Jefferson County Conservation! We hope to catch the tail end of the songbird migration and the front end of the waterfowl migration. There will be plenty of birds to see and fun to be had! This trip is free, but advanced registration is required.

Iowa Young Birders welcomes everyone to the outdoors regardless of age, race, ethnicity, gender, orientation, religion, creed, national origin, or disability status. Our events can accommodate wheelchairs, vision and hearing impairments, and other health conditions. For questions, or to request accommodations for an upcoming event, please send us a message or email. As an IAYB event, this field trip is open to young birders and their parents/guardians/caretakers

9:00 am to 12:00 pm

Jefferson County Health Center-Wellness Loop

JCHC EmpowerU Health and Wellness Fair

2000 S. Main St.Fairfield, IA

Map to Event

October 5, 2024

9:00 am · 12:00 pm

We are excited to announce the EmpowerU Health and Wellness Fair to be held this Saturday, October 5th, 2024, from 9 AM to 12 PM. This event will take place outdoors on the beautiful Wellness Loop at the Health Center, offering a unique opportunity for the community to come together and focus on improving overall health and well-being. Admission is free, and attendees of all ages are welcome! EmpowerU is designed to provide community members with the knowledge, resources, and tools needed to live a healthier, happier life. With the theme "Awareness Today, Healthier Tomorrow," this year’s event will include a vendor fair offering valuable information on health and wellness, live demonstrations, and interactive activities for all ages. Exciting Features at EmpowerU: Emergency Response in Action: Watch as local fire departments, EMS teams, and helicopter crews work together in a live vehicle extrication demo. See firsthand how firefighters, paramedics, and helicopter medical teams collaborate to save lives in a staged accident scenario. Drone Flight Demonstration: The Jefferson County Sheriff's Office will provide an exciting demonstration of their drone technology, showcasing its role in modern emergency and law enforcement scenarios. Art Therapy Breakout Activity: Attendees can explore how art can be used as a tool for mental well-being and stress relief during this hands-on breakout session. Stretching Demonstrations: Learn simple, effective stretching techniques from JCHC Physical Therapists that you can incorporate into your daily routine to enhance flexibility and reduce stress. Kids Zone: A dedicated space where children can enjoy physical activities, crafts, and games — all while learning about the importance of wellness. "EmpowerU is more than a health fair,” shared Amy Vetter, Marketing and Community Relations Manager at JCHC. “It is an opportunity for people to take control of their health and learn valuable tips and strategies to enhance their well-being. Whether you're interested in physical health, mental well-being, or wellness resources for your family, there’s something here for everyone." The event will also feature 34 health and wellness vendors featuring a variety of resources from nutritional information, physical activity, to senior care resources to help you on your journey to a healthier life.

For More InformationContact: Danielle Townsend

(641) 469-4187

dtownsend@jchc.org

Website

7:00 pm to 10:00 pm

Sondheim Center of Performing Arts

Fallin' For The Blues

200 N. Main StreetFairfield, IA

Map to Event

October 5, 2024

7:00 pm · 10:00 pm

**Presented by the Southeast Iowa Blues Society — Not included in Fairfield Arts & Convention Center season passes or packages. All proceeds to Southeast Iowa Blues Society.**

This October, Fall for the Blues with Southeast Iowa Blues Society!

Dance the night away in Fairfield Arts & Convention Center’s Expo Hall with not one but TWO powerhouse blues bands.

First, the Cedar County Cobras get the night set off right with their “old time,” boot-stompin’ blues sound from 7:00 – 7:45 pm.

And then superstars Ghost Town Blues Band take it home from 8:00 – 10:00 pm with horns, harmonies, and raspy “Dr. John-like, whiskey and gravel-soaked vocals.”

Sweet n’ Saucy BBQ will be there to keep you going, and a full cash bar will be ready to soothe your dancing feet.

Tickets on sale at the door or right here beginning September 12th. $20 ($15 for SIBS members)

For More Informationinfo@fairfieldacc.com

10:00 am to 2:00 pm

Brunch Pop- Up at Due South

102 N 2nd StMap to Event

October 6, 2024

10:00 am · 2:00 pm

We are launching a pop-up series that is bound to keep dining in Fairfield, fresh and fun!

Our weekly Brunch service is making an immediate jump to a once a month pop-up as part of the new series! This decision comes after months of wildly inconsistent turn out for a service that requires a considerable amount of prep and staff to execute. We love brunch and want to continue to offer it. The pop-up concept allows us to make it even more special and have more fun with our menu and offerings!

Brunch Pop-up: every second Sunday - starts September 8.

Oyster Bar Pop-up: monthly on Wednesdays, next one is August 21st!

Family Supper Club Pop-up: Monthly on Wednesdays, kicking off on September 4th

In the meantime, join us tonight for dinner, 5-9

10:00 am to 12:00 pm

Jefferson County Park Nature Center

October Birdy Brunch

2003 Libertyville RdFairfield, IA

Map to Event

October 7, 2024

10:00 am · 12:00 pm

Join Naturalist, Austin Roe, for an indoor discussion on backyard birds and what you can do to attract more this fall. Then enjoy a nice hike through Jefferson County Park in search of birds. Bring your own binoculars is recommended, but we do have limited pairs to borrow if needed.

For More InformationNaturalist@JeffersonCountyConservation.com

1:00 pm to 3:00 pm

Chautauqua Park

Not so Scary Hayride

East Burlington Avenue and North Park StreetFairfield, IA

Map to Event

October 7, 2024

1:00 pm · 3:00 pm

An event for young kids. a fun and festive hayride around Chautauqua Park. Children must be accompanied by an adult.

3:00 pm to 6:00 pm

On the Square

Summer Outdoor Farmer's Market

October 9, 2024

3:00 pm · 6:00 pm

Summer Outdoor Market

Now through October 30

Wednesdays on the Square 3:00-6:00pm

Saturdays at Howard Park 8:00am- 1:00pm

7:00 pm to 10:00 pm

Noble House

Music with Adam Sinclair

115 North MainFairfield, IA

Map to Event

October 9, 2024

7:00 pm · 10:00 pm

We are having music once a month on every second Wednesday at 7pm with Adam Sinclair. ![]() Come enjoy some tunes while sipping on our house drinks.

Come enjoy some tunes while sipping on our house drinks. ![]()

(641) 472-2111

chamber@fairfieldiowa.com

7:00 pm to 10:00 pm

Noble House Kava

Music w/ Adam Sinclair

115 N. Main StreetFairfield, IA

Map to Event

October 9, 2024

7:00 pm · 10:00 pm

We are having music once a month on every second Wednesday at 7pm with Adam Sinclair. ![]() Come enjoy some tunes while sipping on our house drinks.

Come enjoy some tunes while sipping on our house drinks. ![]()

4:00 pm to 7:00 pm

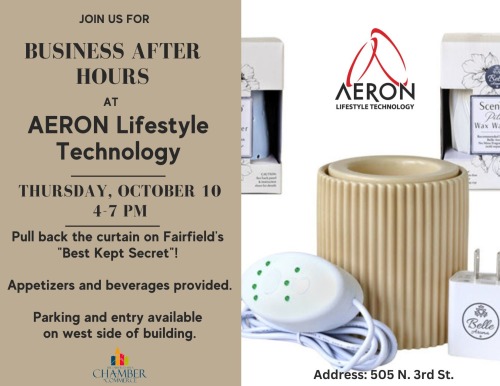

AERON Lifestyle Technologies

Business After Hours: AERON Lifestyle Technologies

October 10, 2024

4:00 pm · 7:00 pm

Pull back the curtain on Fairfield's "Best Kept Secret"! Appetizers and beverages provided.

Parking and entry available on west side of building.

Website

6:00 pm to 9:00 pm

Noble House Kava

Arts & Crafts

115 N. Main StreetFairfield, IA

Map to Event

October 10, 2024

6:00 pm · 9:00 pm

Have any half-finished projects gathering dust? Well here’s your chance to finally make some progress! Feel free to bring any crafts you’ve been meaning to work on. We are also encouraged to bring any extra supplies that you wouldn’t mind letting others use!!

Every second Thursday of the month with Jo & Catherine. ![]()

Relax with some kava, get creative with some kratom and we will see you at Noble House!

7:30 pm to 9:00 pm

Sondheim Center for Performing Arts

Get the Led Out

200 N. Main StreetFairfield, IA

Map to Event

October 10, 2024

7:30 pm · 9:00 pm

Experience the timeless power and energy of Led Zeppelin’s greatest hits with Get the Led Out. This band, known as “The American Led Zeppelin,” meticulously recreates the studio recordings of the iconic rock band with passion and precision. From “Stairway to Heaven” to “Whole Lotta Love,” they deliver the songs with an authenticity that captures the essence of Led Zeppelin’s legendary sound.

More than just a tribute band, Get the Led Out brings a full concert experience with a high-energy performance that immerses audiences in the glory days of rock and roll. Featuring a group of talented musicians dedicated to faithfully reproducing the intricate layers of the original recordings, they promise an unforgettable night for Zeppelin fans and rock enthusiasts alike.

Tickets: $27-$55

OR bundle your tickets and SAVE this season with a custom package built just for you!

*Pick 3 Shows and Save 10% ($63-$182)

*Pick 6 Shows and Save 15% ($151-$320)

*Or, maximize your savings with an All-Access Season Pass and Save 20% on ALL 12 Shows in the 2024-25 Season! ($348-$510)

Call our Box Office at (641) 472-ARTS with any questions, or to get special group discounts and youth pricing!

For More Informationinfo@fairfieldacc.com

5:00 pm

Chautauqua Park

FPL Family Bike Ride

Fairfield, IAOctober 11, 2024

5:00 pm

FPL Family Bike Ride Upcoming Dates: May 17th, June 14th, July 12th, Aug. 9th, Sept. 13th, and Oct. 11th Location: Chautauqua Park Audience: All Ages Join FPL volunteer Wayne Ades for a Family Bike Ride the second Friday of each month at Chautauqua Park. Meet at the entrance to the trail at Chautauqua at 5:00 PM and the ride will begin at 5:15. All participants age 10 and under should be accompanied by an adult. If you need disability-related accommodations in order to participate in this event, please contact the library. For all other questions, contact the FPL Front Desk at at 641-472-6551, Ext. 2.

For More InformationContact: Front Desk

(641) 472-6551

circ@fairfield.lib.ia.us

Website

8:00 am to 1:00 pm

Howard Park

Summer Outdoor Farmer's Market

October 12, 2024

8:00 am · 1:00 pm

Summer Outdoor Market

Now through October 30

Wednesdays on the Square 3:00-6:00pm

Saturdays at Howard Park 8:00am- 1:00pm

8:00 am to 1:00 pm

Howard Park

Farmers Market

East Grimes Ave and North Main StFairfield, IA

Map to Event

October 12, 2024

8:00 am · 1:00 pm

Nothing beats fresh grown produce and if that’s your thing, then head to the Fairfield Farmers market! Fairfield’s Farmers Market is a popular and festive summer event where fresh local produce catches your eye in every direction you look. All the items sold at the Farmers market are home grown and produced right here in Jefferson County. Alongside the array of fruits, vegetables, and baked goods, local vendors provide a vast selection of handmade arts and crafts Located in Howard Park, which is close by the new Fairfield Arts and Convention Center, the Farmers Market begins the first Saturday of May and continues until the last Saturday of October. The park offers a well-equipped playground for the kids to run around while you handpick your goodies. The Farmers Market is open Wednesdays and Saturdays May through October

Cedar Valley Winery

Cedar Valley Winery Lodge Now Open for Bookings!

2034 Dewberry AvenueBatavia, IA

Map to Event

October 14, 2024

Cedar Valley Winery

Lodge

Now Open for Bookings!

This spacious, modern B&B is just waiting to accommodate your visit. Be it a hunting trip or just a getaway, this 3 bedroomed, 12 berth lodge boasts full amenities. From wifi to laundry facilities. Just arrive and this gem nesteled between luscious vineyards with a panorama to boot, will do the rest! Whether family vacay or hunting weekend. This venue awaits!

For bookings call 641-662-2800

2034 Dewberry Ave, Batavia

For More InformationContact: Cedar Valley Winery

(641) 662-2800

Website

12:00 pm to 1:00 pm

Golden Magnolia Sanctuary

Ribbon Cutting at Golden Magnolia Sanctuary

200 South MainFairfield, IA

Map to Event

October 14, 2024

12:00 pm · 1:00 pm

Join our Chamber Ambassadors as we welcome Golden Magnolia Sanctuary to our Chamber family at noon.

9:00 am to 10:00 am

Zoom

Virtual Coffee Break - How to Get More Customers

15330 Truman StreetOttumwa, IA

Map to Event

October 16, 2024

9:00 am · 10:00 am

Discover essential strategies to gain more customers. Learn effective techniques in targeting your audience, enhancing your online presence, and leveraging SEO and social media. Gain insights into creating compelling content, using paid advertising, and delivering exceptional customer service.

For More InformationContact: Marissa Long

(641) 683-5312

marissa.long@indianhills.edu

Website

9:00 am to 11:00 am

Jefferson County Park Nature Center

Toddler Time: October

2003 Libertyville RdFairfield, IA

Map to Event

October 16, 2024

9:00 am · 11:00 am

Geared for youth 2-4 years of age and an adult.

Explore the great outdoors alongside your child! We will be doing a short introduction before heading out on a hike. This children’s nature program is geared for children who are 2-4 years old. Children must be accompanied by an adult.

Naturalist@JeffersonCountyConservation.com

3:00 pm to 6:00 pm

On the Square

Summer Outdoor Farmer's Market

October 16, 2024

3:00 pm · 6:00 pm

Summer Outdoor Market

Now through October 30

Wednesdays on the Square 3:00-6:00pm

Saturdays at Howard Park 8:00am- 1:00pm

5:00 pm to 8:15 pm

Fairfield Arts and Convention Center

Meet the Candidate Forum

200 North MainFairfield, IA

Map to Event

October 16, 2024

5:00 pm · 8:15 pm

The Fairfield Area Chamber of Commerce is pleased to announce a Meet the Candidate Event on Wednesday, October 16, providing local residents the opportunity to hear from candidates running for office. The event will be held at Fairfield Arts and Convention Center and will be live streamed by the Fairfield Media Center for those unable to attend in person.

This event is designed for voters to learn more about each candidate’s platform in a relaxed, non-debate setting. Questions will pertain to topics important to Chamber member businesses.

"We’re excited to offer a forum where voters can meet the candidates face-to-face and get to know their vision for our community," said Chamber Director Mendy McAdams. "The live stream by Fairfield Media Center ensures that even those who can’t join in person will have a chance to participate in this important community event."

Each candidate will have a few minutes to address the audience about what’s important to them. From 6 pm to 7 pm, Representative Jeff Shipley and candidate Thomas O’Donnell will be on stage. From 7 pm to 8pm, Senator Adrian Dickey and candidate Lisa Ossian will take their turn. All candidates will have a few minutes for closing.

Seats running unopposed will not be featured in this forum. We will be enforcing time limits per question. This is the public’s opportunity to meet the candidates and see where they stand on the issues.

This event is free and open to the public. People can be very passionate about politics and the Chamber expects the public to be respectful and kind. No shouting from the audience will be tolerated and there will be no questions from the audience. We expect everyone to behave appropriately.

For more information, please contact the Chamber at 641-472-2111 or visit our website at www.FairfieldIowa.com.

For More Information

(641) 472-2111

chamber@fairfieldiowa.com

6:00 pm to 9:30 pm

Noble House

Richard Morell Tarot Readings

115 N MainFairfield, IA

Map to Event

October 16, 2024

6:00 pm · 9:30 pm

Richard Morell will be doing Tarot Readings Every 3rd Wednesday at 5 pm at Noble House Kava. He has been reading for 40 years.

Pricing: $25 for a full Celtic Cross, $15 for a 5-card reading.

Bio for Tarot Readings

Despite his parents having forbidden his acquiring a tarot deck, Richard Morell got his first Rider-Waite pack 41 years ago, when he was a college freshman. He has been studying the cards and reading for people ever since. Richard began to read professionally in 2006 when he hung out his shingle in Albany, New York.

For the last 10 years, Richard has managed the Advisors Page at astrologyanswers.com. When he lived in Laramie, Wyoming, Richard could be counted on to read for the locals every Saturday at the Herb House. He is also a gifted Western astrologer–having been reading charts since age 7–as well as a capable numerologist.

6:00 pm to 9:30 pm

Noble House Kava

Richard Morell Tarot Readings

115 N. Main StreetFairfield, IA

Map to Event

October 16, 2024

6:00 pm · 9:30 pm

Richard Morell will be doing Tarot Readings Every 3rd Wednesday at 5 pm at Noble House Kava. He has been reading for 40 years.

Pricing: $25 for a full Celtic Cross, $15 for a 5-card reading.

Bio for Tarot Readings

Despite his parents having forbidden his acquiring a tarot deck, Richard Morell got his first Rider-Waite pack 41 years ago, when he was a college freshman. He has been studying the cards and reading for people ever since. Richard began to read professionally in 2006 when he hung out his shingle in Albany, New York.

For the last 10 years, Richard has managed the Advisors Page at astrologyanswers.com. When he lived in Laramie, Wyoming, Richard could be counted on to read for the locals every Saturday at the Herb House. He is also a gifted Western astrologer–having been reading charts since age 7–as well as a capable numerologist.

5:00 pm to 7:00 pm

Jefferson County Fairgrounds

Trunk or Treat

2606 W Burlington AveFairfield, IA

Map to Event

October 18, 2024

5:00 pm · 7:00 pm

Save the Date!

The Jefferson County Extension and Outreach would like to invite you to their annual Trunk or Treat at the Jefferson County Fairgrounds.

Trunk or Treat will be on October 18th, 2024, at the Jefferson County Fairgrounds from 5:00 to 7:00 p.m.

Join us along with surrounding businesses to celebrate the Halloween Season in your festive costumes with fun games, activities, and treats!

7:00 pm to 9:00 pm

Noble House

Trivia Night

115 N. Main StreetFairfield, IA

Map to Event

October 18, 2024

7:00 pm · 9:00 pm

We are going to have a mystery subject trivia on the 3rd Friday of the month*. Starts at 7pm!

*Unless posted otherwise.

Our Noble House karaoke star Marshall is going to host.

2nd place gets a round of free kava shots & 1st place gets a Noble House gift card for $25.

We look forward to seeing you there.

7:00 pm

Central Park Square

Movies in the Park

107 S Main StFairfield, IA

Map to Event

October 18, 2024

7:00 pm

Join us again this summer at Central Park for our free summer movies! Movies begin at sunset!

October 18 – Monster House

7:30 pm to 9:00 pm

Sondheim Center for Performing Arts

The Electric Light Orchestra Experience ft. Evil Woman - The American ELO

200 N. Main StreetFairfield, IA

Map to Event

October 18, 2024

7:30 pm · 9:00 pm

— Fans of classic rock are in for a treat as the Electric Light Orchestra Experience takes the stage at Fairfield Arts & Convention Center on Friday, October 18, at 7:30 PM! This live tribute brings to life the iconic sounds of ELO, blending rock and orchestral elements in a celebration of timeless hits.

Audiences can expect to hear favorites like “Mr. Blue Sky,” “Evil Woman,” and “Don’t Bring Me Down” in a dynamic performance that captures the essence of Electric Light Orchestra’s groundbreaking fusion of rock and symphony.

“The Electric Light Orchestra Experience will offer an unforgettable evening for ELO fans and music lovers alike,” said Lindsay Bauer, Executive Director of Fairfield Arts & Convention Center. “We’re thrilled to bring this world-class tribute to Fairfield and relive the magic of one of rock’s most innovative bands.”

Tickets for this one-night-only event won’t last long. Visit fairfieldacc.com or call the Box Office at (641) 472-ARTS to get your tickets today!

For More Informationinfo@fairfieldacc.com

8:00 am to 1:00 pm

Howard Park

Summer Outdoor Farmer's Market

October 19, 2024

8:00 am · 1:00 pm

Summer Outdoor Market

Now through October 30

Wednesdays on the Square 3:00-6:00pm

Saturdays at Howard Park 8:00am- 1:00pm

8:00 am to 1:00 pm

Howard Park

Farmers Market

East Grimes Ave and North Main StFairfield, IA

Map to Event

October 19, 2024

8:00 am · 1:00 pm

Nothing beats fresh grown produce and if that’s your thing, then head to the Fairfield Farmers market! Fairfield’s Farmers Market is a popular and festive summer event where fresh local produce catches your eye in every direction you look. All the items sold at the Farmers market are home grown and produced right here in Jefferson County. Alongside the array of fruits, vegetables, and baked goods, local vendors provide a vast selection of handmade arts and crafts Located in Howard Park, which is close by the new Fairfield Arts and Convention Center, the Farmers Market begins the first Saturday of May and continues until the last Saturday of October. The park offers a well-equipped playground for the kids to run around while you handpick your goodies. The Farmers Market is open Wednesdays and Saturdays May through October

10:00 am

DGM: Fairfield, IA Pottery Studio

Come Play with Clay: Beginning Wheel Throwing with Jessi Tucci

400 N 2nd Street, Fairfield, IA, United States, Iowa 52556Map to Event

October 19, 2024

10:00 am

All Skill Levels are Welcome!

Already attended a Beginning Wheel Class with Jessi? Sign-up and come out again! Continue to practice your skills, and get expert feedback guidance - build muscle memory!!

This workshop is about the experience of learning to work with a pottery wheel. It is a great way to experience firsthand working with clay.

Watch demonstrations from Jessi Tucci, ask questions and then try your own hand at throwing several pieces.

This workshop will expose you to: how to center clay on the wheel, and how to pull a small form (cups or bowls). This class is about the process of working with clay on the wheel rather than a specific outcome.

Each participant will complete at least 1-2 cups or bowls.

If desired the Studio Team will glaze and fire your creation to make it food-microwave-dishwasher safe -- for pick-up at a later date.

Instructor, Materials, Supplies, Tools and Equipment are included.

What to wear: Students must wear closed toed shoes for safety and ceramic wheel students should wear clothes they do not mind getting messy.

PLEASE BE ON TIME

Cancellation policy: DGM reserves the right to cancel sessions due to the minimum enrollment not being met - refunds will be issued within 10 days of event cancellation. Participants may not cancel their session for a refund. Tickets are transferable with advance notice.

Location

Deep Green Machine, Inc

400 North 2nd Street Fairfield, Iowa 52556

Telephone: 660 223 3691 Email: frank@deepgreenmachine.com

Located BEHIND TACO DREAMS/THE BAKEHOUSE - See attached photo for exact location

Get Tickets: HERE

About Instructor Jessi Tucci

Jessi Tucci has been working with clay for 15 years.

She had found a wheel in the back of her high school's ceramic room and begged her teacher to use it. With too many students in one class she had to stay after school hours to play around on the wheel.

It was an immediate addiction.

Restless after high school Jessi moved around the country and every semester, at every college Jessi took a ceramic class, even after she had way too many art credits. Functional pottery is her passion.

1:00 pm

DGM: Fairfield, IA Pottery Studio

Come Play with Clay: Beginning Wheel Throwing with Jessi Tucci

400 N 2nd Street, Fairfield, IA, United States, Iowa 52556Map to Event

October 19, 2024

1:00 pm

All Skill Levels are Welcome!

Already attended a Beginning Wheel Class with Jessi? Sign-up and come out again! Continue to practice your skills, and get expert feedback guidance - build muscle memory!!

This workshop is about the experience of learning to work with a pottery wheel. It is a great way to experience firsthand working with clay.

Watch demonstrations from Jessi Tucci, ask questions and then try your own hand at throwing several pieces.

This workshop will expose you to: how to center clay on the wheel, and how to pull a small form (cups or bowls). This class is about the process of working with clay on the wheel rather than a specific outcome.

Each participant will complete at least 1-2 cups or bowls.

If desired the Studio Team will glaze and fire your creation to make it food-microwave-dishwasher safe -- for pick-up at a later date.

Instructor, Materials, Supplies, Tools and Equipment are included.

What to wear: Students must wear closed toed shoes for safety and ceramic wheel students should wear clothes they do not mind getting messy.

PLEASE BE ON TIME

Cancellation policy: DGM reserves the right to cancel sessions due to the minimum enrollment not being met - refunds will be issued within 10 days of event cancellation. Participants may not cancel their session for a refund. Tickets are transferable with advance notice.

Location

Deep Green Machine, Inc

400 North 2nd Street Fairfield, Iowa 52556

Telephone: 660 223 3691 Email: frank@deepgreenmachine.com

Located BEHIND TACO DREAMS/THE BAKEHOUSE - See attached photo for exact location

Get Tickets: HERE

About Instructor Jessi Tucci

Jessi Tucci has been working with clay for 15 years.

She had found a wheel in the back of her high school's ceramic room and begged her teacher to use it. With too many students in one class she had to stay after school hours to play around on the wheel.

It was an immediate addiction.

Restless after high school Jessi moved around the country and every semester, at every college Jessi took a ceramic class, even after she had way too many art credits. Functional pottery is her passion.

4:00 pm

DGM: Fairfield, IA Pottery Studio

Come Play with Clay: Beginning Wheel Throwing with Jessi Tucci

400 N 2nd Street, Fairfield, IA, United States, Iowa 52556Map to Event

October 19, 2024

4:00 pm

All Skill Levels are Welcome!

Already attended a Beginning Wheel Class with Jessi? Sign-up and come out again! Continue to practice your skills, and get expert feedback guidance - build muscle memory!!

This workshop is about the experience of learning to work with a pottery wheel. It is a great way to experience firsthand working with clay.

Watch demonstrations from Jessi Tucci, ask questions and then try your own hand at throwing several pieces.

This workshop will expose you to: how to center clay on the wheel, and how to pull a small form (cups or bowls). This class is about the process of working with clay on the wheel rather than a specific outcome.

Each participant will complete at least 1-2 cups or bowls.

If desired the Studio Team will glaze and fire your creation to make it food-microwave-dishwasher safe -- for pick-up at a later date.

Instructor, Materials, Supplies, Tools and Equipment are included.

What to wear: Students must wear closed toed shoes for safety and ceramic wheel students should wear clothes they do not mind getting messy.

PLEASE BE ON TIME

Cancellation policy: DGM reserves the right to cancel sessions due to the minimum enrollment not being met - refunds will be issued within 10 days of event cancellation. Participants may not cancel their session for a refund. Tickets are transferable with advance notice.

Location

Deep Green Machine, Inc

400 North 2nd Street Fairfield, Iowa 52556

Telephone: 660 223 3691 Email: frank@deepgreenmachine.com

Located BEHIND TACO DREAMS/THE BAKEHOUSE - See attached photo for exact location

Get Tickets: HERE

About Instructor Jessi Tucci

Jessi Tucci has been working with clay for 15 years.

She had found a wheel in the back of her high school's ceramic room and begged her teacher to use it. With too many students in one class she had to stay after school hours to play around on the wheel.

It was an immediate addiction.

Restless after high school Jessi moved around the country and every semester, at every college Jessi took a ceramic class, even after she had way too many art credits. Functional pottery is her passion.

4:00 pm

DGM: Fairfield, IA Pottery Studio

Come Play with Clay: Beginning Wheel Throwing with Jessi Tucci

400 N 2nd Street, Fairfield, IA, United States, Iowa 52556Map to Event

October 19, 2024

4:00 pm

All Skill Levels are Welcome!

Already attended a Beginning Wheel Class with Jessi? Sign-up and come out again! Continue to practice your skills, and get expert feedback guidance - build muscle memory!!

This workshop is about the experience of learning to work with a pottery wheel. It is a great way to experience firsthand working with clay.

Watch demonstrations from Jessi Tucci, ask questions and then try your own hand at throwing several pieces.

This workshop will expose you to: how to center clay on the wheel, and how to pull a small form (cups or bowls). This class is about the process of working with clay on the wheel rather than a specific outcome.

Each participant will complete at least 1-2 cups or bowls.

If desired the Studio Team will glaze and fire your creation to make it food-microwave-dishwasher safe -- for pick-up at a later date.

Instructor, Materials, Supplies, Tools and Equipment are included.

What to wear: Students must wear closed toed shoes for safety and ceramic wheel students should wear clothes they do not mind getting messy.

PLEASE BE ON TIME

Cancellation policy: DGM reserves the right to cancel sessions due to the minimum enrollment not being met - refunds will be issued within 10 days of event cancellation. Participants may not cancel their session for a refund. Tickets are transferable with advance notice.

Location

Deep Green Machine, Inc

400 North 2nd Street Fairfield, Iowa 52556

Telephone: 660 223 3691 Email: frank@deepgreenmachine.com

Located BEHIND TACO DREAMS/THE BAKEHOUSE - See attached photo for exact location

Get Tickets: HERE

About Instructor Jessi Tucci

Jessi Tucci has been working with clay for 15 years.

She had found a wheel in the back of her high school's ceramic room and begged her teacher to use it. With too many students in one class she had to stay after school hours to play around on the wheel.

It was an immediate addiction.

Restless after high school Jessi moved around the country and every semester, at every college Jessi took a ceramic class, even after she had way too many art credits. Functional pottery is her passion.

4:00 pm to 6:00 pm

DGM Fairfield, IA Pottery Studio

Saturday October 19th OPEN POTTERY STUDIO 4:00 PM

400 N 2nd StreetMap to Event

October 19, 2024

4:00 pm · 6:00 pm

Open studio is offered to individuals who have attended private lessons, classes or have prior pottery experience. We cannot provide instruction during open studio hours - only minimal tips and tricks or comments. If you need assistance on the wheel you will have to take a workshop or schedule a private lesson.

(2) Hour Open studio session is $25 and includes approximately 4 pounds of clay. Prepping your clay, setting up & clean up is part of the wheel time. Materials, Supplies, Tools and Equipment are included.

Additional Split Rock Stoneware Cone 6 Clay is sold for $2.00 per pound.

Bisque and Glaze Firing is $8.00 (cash or check payable to Deep Green Machine) for a “coffee cup sized piece.” Volunteer Studio Team will glaze and fire your creation to make it food-microwave-dishwasher safe. Completed works are typically returned in 4-8 weeks depending on kiln availability.

Studio volunteers will trim and glaze your work.

What to wear: Participants must wear closed toed shoes for safety and ceramic wheel students should wear clothes they do not mind getting messy.

PLEASE BE ON TIME

Cancellation Policy DGM reserves the right to cancel sessions due to the minimum enrollment not being met - refunds will be issued within 10 days of event cancellation. Participants *MAY NOT* cancel their session for a refund. Tickets *ARE* transferable with advance notice.

The DGM Fairfield, IA Pottery Studio is located at 400 N 2nd Street, Fairfield, IA 52556 -- Between: The BakeHouse, Taco Dreams Fairfield and the Railroad Tracks.

About Studio Monitor Jessi Tucci

Jessi Tucci has been working with clay for 15 years.

She had found a wheel in the back of her high school's ceramic room and begged her teacher to use it. With too many students in one class she had to stay after school hours to play around on the wheel.

It was an immediate addiction.

Restless after high school Jessi moved around the country and every semester, at every college Jessi took a ceramic class, even after she had way too many art credits. Functional pottery is her passion.

10:00 am to 2:00 pm

Brunch Pop- Up at Due South

102 N 2nd StMap to Event

October 20, 2024

10:00 am · 2:00 pm

We are launching a pop-up series that is bound to keep dining in Fairfield, fresh and fun!

Our weekly Brunch service is making an immediate jump to a once a month pop-up as part of the new series! This decision comes after months of wildly inconsistent turn out for a service that requires a considerable amount of prep and staff to execute. We love brunch and want to continue to offer it. The pop-up concept allows us to make it even more special and have more fun with our menu and offerings!

Brunch Pop-up: every second Sunday - starts September 8.

Oyster Bar Pop-up: monthly on Wednesdays, next one is August 21st!

Family Supper Club Pop-up: Monthly on Wednesdays, kicking off on September 4th

In the meantime, join us tonight for dinner, 5-9

11:00 am to 2:00 pm

Whitham Woods

Fall Trail Drive Through

1893 Business Highway 34Fairfield, IA

Map to Event

October 20, 2024

11:00 am · 2:00 pm

Whitham Woods to Cedar View Trail

Free

Bring the entire family out to enjoy a portion of the Fairfield Loop Trail. The drive will start at Whitham Woods. Participants can then drive along the Fairfield Loop Trail before either choosing to follow the Cedar View trail to the west across the Highway 34 bypass bridge and the Cedar Creek Bridge or by taking the Cedar View Trail to the east to 32nd Street.

Naturalist@JeffersonCountyConservation.com

7:45 am to 8:45 am

Vitalbody Pilates & Movement Studio

Vinyasa: Wake Up Flow Yoga

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 22, 2024

7:45 am · 8:45 am

Class Time 7:55am

For More InformationContact: Vitalbody Pilates Studio

Website

3:30 pm to 5:00 pm

Fairfield Public Library Meeting Room

Shut Up & Write

104 W. Adams AvenueFairfield, IA

Map to Event

October 22, 2024

3:30 pm · 5:00 pm

Shut Up and Write is a chance for writers to sit quietly together and work on their writing projects.

All writers and all experience levels are welcome, and dont worry, no one will see what you've written. This hour is about getting your writing done.

WHAT TO EXPECT

3:30 PM: Quick intros

3:45 PM-4:45 PM: Write for 1 hr.

4:45 PM-5:00 PM: Clean up and Farewells (until next Tuesday!)

WHAT DO YOU NEED TO BRING?

Bring your paper, pens, or laptop (whatever helps you write best). Headphones are optional but recommended.

This event is co-sponsored by Fairfield Public Library and the Maharishi International Writing Center.

If you need disability-related accommodations in order to participate in this event, please contact the library at 641-472-6551 Ext. 1.

Contact: Fairfield Public Library

(641) 472-6551 x1

circ@fairfield.lib.ia.us

Website

5:15 pm to 6:15 pm

Vitalbody Pilates & Movement Studio

Pilates Reformer/Apparatus: Intermediate-Advanced

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 22, 2024

5:15 pm · 6:15 pm

For students who have graduated out of Improvers level. This class will focus on total body core stability, whole body weight balance, continual flowing sequences, and the full repertoire of Pilates Movements, plus some creative variations for fun and refinement of form

Intermediate 2-Advanced is suitable for long-term pilates students without injury, and who have been approved to join this class.

Includes use of full studio: Reformers, Springboard/Tower, Ladder Barrel, Arc Barrels and Chairs.

For More InformationContact: Vitalbody Pilates Studio

Website

6:30 pm to 7:30 pm

Vitalbody Pilates & Movement Studio

Mat Pilates: Intro to Mat (level 0)

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 22, 2024

6:30 pm · 7:30 pm

The full Pilates Method flow! The classical flow is a well designed, full body workout challenge, using body weight and body balance to develop every aspect of your movement, function and breath. We offer Intro to Pilates mat starting with the basic principles, right the way through to Advanced Classes.

Utilizing props such as foam rollers, resistance bands, light hand and ankle weights, and stability balls, these classes develop your core strength & stability whilst also warming you up, and keeping you moving continuously. The higher the level, the more cardio it becomes. With never more than 8 people in a group. (Max 8 students)

- Intro to Vitalbody Pilates: Foundations

- Beginners

- Improvers

- Intermediate

- *Advanced (offered by request, for teachers and those who have truly passed out of all prior repertoire)

All students are required to attend their appropriate level, to develop correct technique and build core stabilizing muscles in a progressive and safe way.

Contact: Vitalbody Pilates Studio

Website

7:30 pm to 8:30 pm

Vitalbody Pilates & Movement Studio

Power Yoga

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 22, 2024

7:30 pm · 8:30 pm

Power Vinyasa Yoga has all of the benefits of Vinyasa Yoga but is a more intense version containing more dynamic movement, more strength postures and more cardio. This version of Vinyasa Yoga was started in the 1990s by people such as Beryl Bender BIrch, Bryan Kest, Larry Schultz and Baron Baptiste.

For More InformationContact: Vitalbody Pilates Studio

Website

9:00 am to 10:00 am

Vitalbody Pilates & Movement Studio

Pilates Reformer/Apparatus: Beginners-Improvers

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 23, 2024

9:00 am · 10:00 am

REQUIRED: NEW STUDENTS MUST TAKE AN INTRO PRIVATE SESSION/CLASSES & BE ASSIGNED A PILATES PROGRAM BEFORE JOINING THIS CLASS.

Beginners Level Class using all studio equipment. These classes allow you to work through your personalized program in a group setting, with supervised teaching. You may also work in synchronized pairs throughout the class, for up to 4.

Learn the full classical beginner's repertoire, as well as contemporary and remedial variations for your individual posture and remedial

For More InformationContact: Vitalbody Pilates Studio

Website

10:15 am to 11:15 am

Vitalbody Pilates & Movement Studio

Pilates: Over 55's Reformer/Apparatus

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 23, 2024

10:15 am · 11:15 am

Specialized programs and sequencing for the needs of those over 55. Bone strengthening, fascia conditioning, mobility enhancing, posture focused, at a good steady pace. Use all Studio equipment incl; Reformer, Springboard, Ladder Barrel and more.

For More InformationContact: Vitalbody Pilates Studio

Website

1:00 pm to 6:00 pm

Fairfield Public Library Meeting Room

Film Noir Double Feature

104 W. Adams AvenueFairfield, IA

Map to Event

October 23, 2024

1:00 pm · 6:00 pm

Join us for an unforgettable evening of shadows, suspense, and sharp dialogue as Fairfield Public Library hosts a Film Noir Double Feature. This special event will feature two iconic classics of the genre that shaped the dark, moody world of film noir.

1:00pm

DETOUR (1945) 1 hr, 7 mins

Described as "indelible pulp poetry," Detour is a gritty tale of fate and fatalism, directed by B-movie auteur Edgar G. Ulmer. Made on a shoestring budget, this cult classic follows a down-on-his-luck hitchhiker drawn into a web of deception, crime, and doom. With no-name stars and threadbare production values, Detour turns its low-budget constraints into a seedy, atmospheric thriller that has become a noir masterpiece.

2:10pm

INTERMISSION

2:30pm

DOUBLE INDEMNITY (1944) 1 hr, 47 mins

Directed by Billy Wilder and based on a story by James M. Cain, Double Indemnity is a definitive film noir, filled with moral ambiguity, sharp wit, and dangerous allure. The film follows an insurance salesman lured into a deadly scheme by a seductive femme fatale. Together, they plot the perfect murder, but things quickly spiral out of control in a tale of greed, betrayal, and doom.

Come for the intrigue, stay for the suspense! This event is free and open to the public. Free popcorn will be provided. Don't miss your chance to experience two of film noir's most iconic films back-to-back on the big screen!

For More InformationContact: Fairfield Public Library

(641) 472-6551 x1

circ@fairfield.lib.ia.us

Website

3:00 pm to 6:00 pm

On the Square

Summer Outdoor Farmer's Market

October 23, 2024

3:00 pm · 6:00 pm

Summer Outdoor Market

Now through October 30

Wednesdays on the Square 3:00-6:00pm

Saturdays at Howard Park 8:00am- 1:00pm

4:00 pm to 5:00 pm

Gazebo in the Square @ Farmer's Market

Market Storytime

Fairfield, IAOctober 23, 2024

4:00 pm · 5:00 pm

Join Youth Librarian Sara Martindale for stories and songs during the Wednesday afternoon Market Storytime. Meet in the gazebo on the Square for storytime aimed at children ages 2-5 with a caregiver, although all ages are welcome to join in the fun!

This event is sponsored in part by Ideal Energy, Everybody's Whole Food Store, Agri-Industrial Plastics, Reed Law, Hy-Vee, and Centered Wealth. Thank you Sponsors!

If you need disability-related accommodations in order to participate in this event or have questions, please contact the FPL Front Desk at 641-472-6551, Ext. 3.

For More InformationContact: Fairfield Public Library

(641) 472-6551 x3

circ@fairfield.lib.ia.us

Website

5:15 pm to 6:15 pm

Vitalbody Pilates & Movement Studio

Pilates Studio Session

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 23, 2024

5:15 pm · 6:15 pm

The Classical way to practice Pilates. In "Classical Studio" sessions you work through your own individually personalised Pilates program, set & intermittently guided by your teacher.

With time and space to focus on your technique, with supervision and guidance by your teacher. Use the full studio of equipment at your own pace, to learn the exercises more fully. Similar to having a private pilates training session but the teacher rotates between each student. (max 4 students per teacher)

All levels welcome. Students must have taken at least one Private Pilates Session, and have been assigned a Personalised In-Studio Program, prior to joining these sessions

For More InformationContact: Vitalbody Pilates Studio

Website

6:30 pm to 7:30 pm

Vitalbody Pilates & Movement Studio

Mat Pilates: Improvers - Inter

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 23, 2024

6:30 pm · 7:30 pm

The full Pilates Method flow! The classical flow is a well designed, full body workout challenge, using body weight and body balance to develop every aspect of your movement, function and breath. We offer Intro to Pilates mat starting with the basic principles, right the way through to Advanced Classes.

Utilizing props such as foam rollers, resistance bands, light hand and ankle weights, and stability balls, these classes develop your core strength & stability whilst also warming you up, and keeping you moving continuously. The higher the level, the more cardio it becomes. With never more than 8 people in a group. (Max 8 students)

- Intro to Vitalbody Pilates: Foundations

- Beginners

- Improvers

- Intermediate

- *Advanced (offered by request, for teachers and those who have truly passed out of all prior repertoire)

All students are required to attend their appropriate level, to develop correct technique and build core stabilizing muscles in a progressive and safe way.

Contact: Vitalbody Pilates Studio

Website

7:30 pm to 8:30 pm

Vitalbody Pilates & Movement Studio

Vinyasa Yoga: Wind Down

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 23, 2024

7:30 pm · 8:30 pm

Like a moving meditation, students in Vinyasa Classes move from one pose to another with the rhythm of the breath; one breath, one movement through a sequence of poses. Resting poses are a place to reconnect with the breath and the breath is used a focal point in longer holds. This technique gets the heart rate going and the the blood flowing. Progressive dynamic stretching allows the body to move into increasingly deeper stretches.

For More InformationContact: Vitalbody Pilates Studio

Website

7:45 am to 8:45 am

Vitalbody Pilates & Movement Studio

Vinyasa: Wake Up Flow Yoga

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 24, 2024

7:45 am · 8:45 am

Class Time 7:55am

For More InformationContact: Vitalbody Pilates Studio

Website

9:00 am to 10:00 am

Vitalbody Pilates & Movement Studio

Pilates Reformer/Apparatus: Intermediate-Advanced

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 24, 2024

9:00 am · 10:00 am

For students who have graduated out of Improvers level. This class will focus on total body core stability, whole body weight balance, continual flowing sequences, and the full repertoire of Pilates Movements, plus some creative variations for fun and refinement of form

Intermediate 2-Advanced is suitable for long-term pilates students without injury, and who have been approved to join this class.

Includes use of full studio: Reformers, Springboard/Tower, Ladder Barrel, Arc Barrels and Chairs.

For More InformationContact: Vitalbody Pilates Studio

Website

11:00 am to 1:30 pm

Fairfield Golf and County Club

Manufacturer's Appreciation Luncheon

October 24, 2024

11:00 am · 1:30 pm

12:00 pm to 1:00 pm

Fairfield CoLab

Traction Thursdays

101 N CourtFairfield, IA

Map to Event

October 24, 2024

12:00 pm · 1:00 pm

All entrepreneurs or aspiring entrepreneurs are welcome to attend. Each meeting features a guest entrepreneur who shares their vision, plans, experience, and needs with the group. Every Thursday at the Fairfield CoLab from 12-1pm.

5:15 pm to 6:15 pm

Vitalbody Pilates & Movement Studio

Pilates Reformer/Apparatus: Improvers - Intermediate

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 24, 2024

5:15 pm · 6:15 pm

For students who graduated out of Beginners level classes. Improvers-Intermediate is suitable for those without injury, and who have been approved to join in this level of class.

This class focuses on building core stability with greater body balance, and more challenging exercises, as well as the transitions between exercises, and flowing sequences.

Includes use of full studio: Reformers, Springboard/Tower, Ladder Barrel, Arc Barrels and Chair

For More InformationContact: Vitalbody Pilates Studio

Website

6:30 pm to 7:30 pm

Vitalbody Pilates & Movement Studio

Mat Pilates: Beginners - Improvers

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 24, 2024

6:30 pm · 7:30 pm

The full Pilates Method flow! The classical flow is a well designed, full body workout challenge, using body weight and body balance to develop every aspect of your movement, function and breath. We offer Intro to Pilates mat starting with the basic principles, right the way through to Advanced Classes.

Utilizing props such as foam rollers, resistance bands, light hand and ankle weights, and stability balls, these classes develop your core strength & stability whilst also warming you up, and keeping you moving continuously. The higher the level, the more cardio it becomes. With never more than 8 people in a group. (Max 8 students)

- Intro to Vitalbody Pilates: Foundations

- Beginners

- Improvers

- Intermediate

- *Advanced (offered by request, for teachers and those who have truly passed out of all prior repertoire)

All students are required to attend their appropriate level, to develop correct technique and build core stabilizing muscles in a progressive and safe way.

Contact: Vitalbody Pilates Studio

Website

7:30 am to 8:30 am

Vitalbody Pilates & Movement Studio

Yin Fusion Yoga

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 25, 2024

7:30 am · 8:30 am For More Information

Contact: Vitalbody Pilates Studio

Website

9:00 am to 10:00 am

Vitalbody Pilates & Movement Studio

Pilates Reformer/Apparatus: Beginners-Improvers

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 25, 2024

9:00 am · 10:00 am

REQUIRED: NEW STUDENTS MUST TAKE AN INTRO PRIVATE SESSION/CLASSES & BE ASSIGNED A PILATES PROGRAM BEFORE JOINING THIS CLASS.

Beginners Level Class using all studio equipment. These classes allow you to work through your personalized program in a group setting, with supervised teaching. You may also work in synchronized pairs throughout the class, for up to 4.

Learn the full classical beginner's repertoire, as well as contemporary and remedial variations for your individual posture and remedial

For More InformationContact: Vitalbody Pilates Studio

Website

10:15 am to 11:15 am

Vitalbody Pilates & Movement Studio

Pilates: Over 55's Reformer/Apparatus

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 25, 2024

10:15 am · 11:15 am

Specialized programs and sequencing for the needs of those over 55. Bone strengthening, fascia conditioning, mobility enhancing, posture focused, at a good steady pace. Use all Studio equipment incl; Reformer, Springboard, Ladder Barrel and more.

For More InformationContact: Vitalbody Pilates Studio

Website

1:00 pm to 4:00 pm

FPL Meeting Room

Mah Jongg @ FPL

104 W AdamsFairfield, IA

Map to Event

October 25, 2024

1:00 pm · 4:00 pm

Mah Jongg Date & Time: Every Friday from 1-4pm Location: Fairfield Public Library Meeting Room Audience: Adults Mah Jongg is a tile-based game that was developed in the 19th century in China and has spread throughout the world since the early 20th century. Players at FPL play an American variation of the game every week at the library. Stop by and see how the game is played and join the group if you want to learn the game. Teaching instruction for new players will take place the first Friday of each month. The library also offers introductory books for check-out. If you need special assistance to join this program due to a disability, please contact the FPL Front Desk at 641-451-6551 Ext. 1 or circ@fairfield.lib.ia.us.

For More InformationContact: Front Desk

(641) 472-6551

circ@fairfield.lib.ia.us

Website

8:00 am to 1:00 pm

Howard Park

Summer Outdoor Farmer's Market

October 26, 2024

8:00 am · 1:00 pm

Summer Outdoor Market

Now through October 30

Wednesdays on the Square 3:00-6:00pm

Saturdays at Howard Park 8:00am- 1:00pm

8:00 am to 1:00 pm

Howard Park

Farmers Market

East Grimes Ave and North Main StFairfield, IA

Map to Event

October 26, 2024

8:00 am · 1:00 pm

Nothing beats fresh grown produce and if that’s your thing, then head to the Fairfield Farmers market! Fairfield’s Farmers Market is a popular and festive summer event where fresh local produce catches your eye in every direction you look. All the items sold at the Farmers market are home grown and produced right here in Jefferson County. Alongside the array of fruits, vegetables, and baked goods, local vendors provide a vast selection of handmade arts and crafts Located in Howard Park, which is close by the new Fairfield Arts and Convention Center, the Farmers Market begins the first Saturday of May and continues until the last Saturday of October. The park offers a well-equipped playground for the kids to run around while you handpick your goodies. The Farmers Market is open Wednesdays and Saturdays May through October

10:00 am to 11:00 am

Vitalbody Pilates & Movement Studio

Mat Pilates: Classical Flow levels 2-4

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 26, 2024

10:00 am · 11:00 am

The full Pilates Method flow! The classical flow is a well designed, full body workout challenge, using body weight and body balance to develop every aspect of your movement, function and breath. We offer Intro to Pilates mat starting with the basic principles, right the way through to Advanced Classes.

Utilizing props such as foam rollers, resistance bands, light hand and ankle weights, and stability balls, these classes develop your core strength & stability whilst also warming you up, and keeping you moving continuously. The higher the level, the more cardio it becomes. With never more than 8 people in a group. (Max 8 students)

- Intro to Vitalbody Pilates: Foundations

- Beginners

- Improvers

- Intermediate

- *Advanced (offered by request, for teachers and those who have truly passed out of all prior repertoire)

All students are required to attend their appropriate level, to develop correct technique and build core stabilizing muscles in a progressive and safe way.

Contact: Vitalbody Pilates Studio

Website

11:15 am to 12:15 am

Vitalbody Pilates & Movement Studio

Mat Pilates: All levels

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 26, 2024

11:15 am · 12:15 am

The full Pilates Method flow! The classical flow is a well designed, full body workout challenge, using body weight and body balance to develop every aspect of your movement, function and breath. We offer Intro to Pilates mat starting with the basic principles, right the way through to Advanced Classes.

Utilizing props such as foam rollers, resistance bands, light hand and ankle weights, and stability balls, these classes develop your core strength & stability whilst also warming you up, and keeping you moving continuously. The higher the level, the more cardio it becomes. With never more than 8 people in a group. (Max 8 students)

- Intro to Vitalbody Pilates: Foundations

- Beginners

- Improvers

- Intermediate

- *Advanced (offered by request, for teachers and those who have truly passed out of all prior repertoire)

All students are required to attend their appropriate level, to develop correct technique and build core stabilizing muscles in a progressive and safe way.

Contact: Vitalbody Pilates Studio

Website

9:00 am to 10:00 am

Vitalbody Pilates & Movement Studio

Vinyasa Yoga; Strength & Flow

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 27, 2024

9:00 am · 10:00 am

Vinyasa yoga is a creative form of yoga where poses are linked together with the breath in a flowing sequence.

The beauty of Vinyasa yoga is the variety. There is no standard sequence in Vinyasa yoga, so the style, pace and intensity will all vary depending on the teacher. Classes may be sequenced around a peak pose such as a backbend, or they might focus on a particular theme such as the chakras or an aspect of yoga philosophy. The class may be dynamic and focus on strengthening postures, or it may be a slower flow with an emphasis on mobility and flexibility in the spine or the hips.

For More InformationContact: Vitalbody Pilates Studio

Website

11:15 am to 12:15 am

Vitalbody Pilates & Movement Studio

Belly Fit (Dance/Fitness)

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 27, 2024

11:15 am · 12:15 am For More Information

Contact: Vitalbody Pilates Studio

Website

1:30 pm to 3:00 pm

FPL Meeting Room

Write On Writers

104 W AdamsFairfield, IA

Map to Event

October 27, 2024

1:30 pm · 3:00 pm

Bring a pen and paper and share what you’ve written in a friendly, open discussion. No experience is necessary. All skill levels and writing genres are welcome and there is no charge for the program.

To register, call the library’s front desk at 641-472-6551 ext. 1.

For More InformationContact: Front Desk

(641) 472-6551 x1

Website

9:00 am to 10:00 am

Vitalbody Pilates & Movement Studio

Pilates Reformer/Apparatus: Improvers - Intermediate

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 28, 2024

9:00 am · 10:00 am

For students who graduated out of Beginners level classes. Improvers-Intermediate is suitable for those without injury, and who have been approved to join in this level of class.

This class focuses on building core stability with greater body balance, and more challenging exercises, as well as the transitions between exercises, and flowing sequences.

Includes use of full studio: Reformers, Springboard/Tower, Ladder Barrel, Arc Barrels and Chair

For More InformationContact: Vitalbody Pilates Studio

Website

10:15 am to 11:15 am

Vitalbody Pilates & Movement Studio

Pilates: Over 55's Reformer/Apparatus

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 28, 2024

10:15 am · 11:15 am

Specialized programs and sequencing for the needs of those over 55. Bone strengthening, fascia conditioning, mobility enhancing, posture focused, at a good steady pace. Use all Studio equipment incl; Reformer, Springboard, Ladder Barrel and more.

For More InformationContact: Vitalbody Pilates Studio

Website

3:30 pm to 5:30 pm

FPL Meeting Room

LEGO Playtime

104 W AdamsFairfield, IA

Map to Event

October 28, 2024

3:30 pm · 5:30 pm

Join for unstructured LEGO playtime every Monday!

If you need disability-related accommodations in order to participate in this event, please contact the FPL Front Desk at at 641-472-6551, Ext. 1.

Contact: Front Desk

(641) 472-6551 x1

Website

4:00 pm to 5:30 pm

FPL Meeting Room & Youth Department

FPL Halloween Party

104 W AdamsFairfield, IA

Map to Event

October 28, 2024

4:00 pm · 5:30 pm

It's an FPL Halloween party! Children ages 0-10 can enjoy a Halloween Storytime, games, craft, snacks, Halloween LEGO challenges and a Spooky scavenger hunt in the youth area. Costumes are welcomed, but not required.

If you need disability-related accommodations in order to participate in this event, please contact the Library at the front desk number listed below.

For all other questions, contact the FPL Front Desk at 641-472-6551, Ext. 3.

Contact: Front Desk

(641) 472-6551 x3

Website

5:15 pm to 6:15 pm

Vitalbody Pilates & Movement Studio

Pilates Studio Session

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 28, 2024

5:15 pm · 6:15 pm

The Classical way to practice Pilates. In "Classical Studio" sessions you work through your own individually personalised Pilates program, set & intermittently guided by your teacher.

With time and space to focus on your technique, with supervision and guidance by your teacher. Use the full studio of equipment at your own pace, to learn the exercises more fully. Similar to having a private pilates training session but the teacher rotates between each student. (max 4 students per teacher)

All levels welcome. Students must have taken at least one Private Pilates Session, and have been assigned a Personalised In-Studio Program, prior to joining these sessions

For More InformationContact: Vitalbody Pilates Studio

Website

6:30 pm to 7:30 pm

Vitalbody Pilates & Movement Studio

Pilates Reformer/Apparatus: Beginners-Improvers

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 28, 2024

6:30 pm · 7:30 pm

REQUIRED: NEW STUDENTS MUST TAKE AN INTRO PRIVATE SESSION/CLASSES & BE ASSIGNED A PILATES PROGRAM BEFORE JOINING THIS CLASS.

Beginners Level Class using all studio equipment. These classes allow you to work through your personalized program in a group setting, with supervised teaching. You may also work in synchronized pairs throughout the class, for up to 4.

Learn the full classical beginner's repertoire, as well as contemporary and remedial variations for your individual posture and remedial

For More InformationContact: Vitalbody Pilates Studio

Website

7:45 am to 8:45 am

Vitalbody Pilates & Movement Studio

Vinyasa: Wake Up Flow Yoga

121 West Broadway Ave, Suite 21Fairfield, IA

Map to Event

October 29, 2024

7:45 am · 8:45 am

Class Time 7:55am

For More InformationContact: Vitalbody Pilates Studio

Website

9:30 am to 12:00 pm

FPL Conference Room

Fairfield City Council Rebroadcast

104 W AdamsFairfield, IA

Map to Event

October 29, 2024

9:30 am · 12:00 pm

Join us at the Fairfield Public Library for a special rebroadcast of the latest City Council meeting. This event offers a great opportunity to stay informed about local decisions and community updates. Enjoy complimentary coffee while you watch, and engage in casual discussions with fellow attendees. The event is open to all, and no registration is required. Come together with your neighbors to stay connected with the latest in local government!

For More InformationContact: Front Desk

(641) 472-6551

Website

10:15 am to 10:45 am

FPL Meeting Room

Songs and Stories with Sara

104 W AdamsFairfield, IA

Map to Event

October 29, 2024

10:15 am · 10:45 am

Join Childrens Librarian Sara Martindale for stories, songs, and rhymes! This Storytime is aimed at children ages 0-3 with a caregiver, but all ages are welcome to join in the fun!

If you need disability-related accommodations in order to participate in this event, please contact the Library at the front desk number listed below.

For all other questions, contact the FPL Front Desk at 641-472-6551, Ext. 1.

Contact: Front Desk

(641) 472-6551 x1

Website

11:00 am

Jefferson County Health Center

JCHC Little Food Pantry Ribbon Cutting

2000 S. Main Street - Parking Lot of the Dialysis CenterFairfield, IA

Map to Event

October 29, 2024

11:00 am

We are honored to invite you to join Jefferson County Health Center (JCHC), the JCHC Foundation, and the family of Dr. Jay Heitsman for a special ribbon-cutting ceremony to celebrate the opening of the new Little Food Pantry located on the JCHC campus, in the parking lot of the Dialysis Center.

Thanks to the generous donation from the Heitsman family in memory of Dr. Jay Heitsman, this project has come to fruition. Dr. Heitsman was a beloved pediatrician at JCHC, known for his gentle smile, caring touch, and passion for children. His legacy of service to the community lives on through this pantry, designed and built by JCHC staff member and personal friend, Denis Walker.

The Little Food Pantry has already been stocked with items from the Community Team's Annual Food Drive and has been added to the Jefferson County Little Free Pantries Map. This pantry is part of the Little Free Pantry movement, which provides immediate, anonymous support to those in need by offering free food, nourishing neighborhoods, and helping neighbors feed neighbors.